Let's talk about key indicators that will show if the crypto market is still going up, or if we're starting a downturn.

We'll keep it simple and also point out the important levels to watch in the next few weeks.

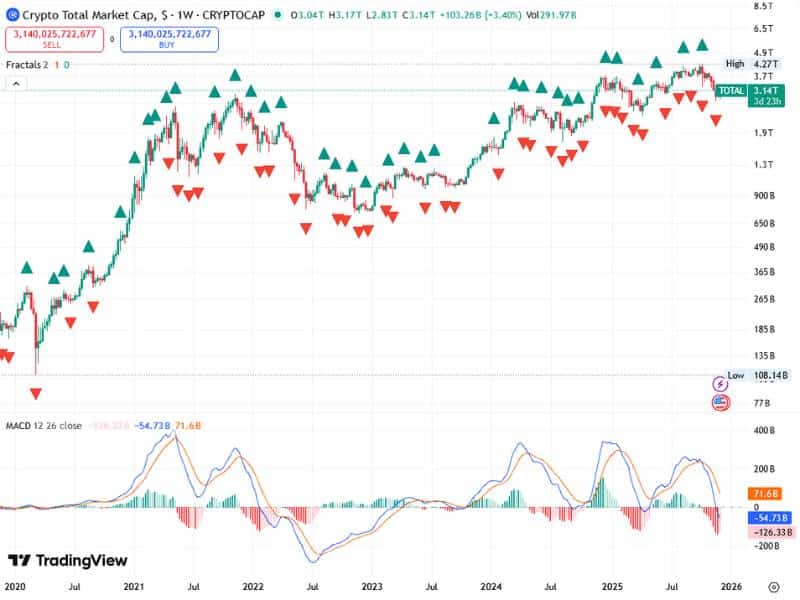

Reading Crypto Market Trends

Want to understand the crypto market better? Check out its wave-like movements. The market tends to repeat patterns.

When the market is on an uptrend, it often goes up in five waves:

Waves 1, 3, and 5 push the price higher.

Waves 2 and 4 are small pullbacks.

Once those five waves complete, the uptrend often starts to weaken, and the market becomes more likely to pull back.

The same idea applies when the market falls. It follows the same pattern, but in the opposite direction.

Knowing these waves can give you a sense of the market's strength. It's a simple way to see what's going on.

Last Year's Highs: A Warning Sign

Last year, when the total crypto market value reached new highs, a full five-wave pattern was completed. The bull run could have ended then.

We were still somewhat positive since the market was still going up, which it did. And it all came down to $3.5 trillion.

Once the market dropped below $3.5T, the chance of more gains went down a lot. This drop matches the pullback we're seeing now with Bitcoin and other cryptos.

Why Losing a Big Level Doesn't End the Bull Market

A common mistake people make is losing a big level, and that doesn't mean the bull market is over right away. The big picture only turns negative if the market breaks its last major higher low. If that low holds, the long-term view is still good—even during big drops.

That’s why market structure is more important than just looking at dips.

Zooming In: What's Happening with the Downward Trend

Since the market dipped below $3.5T, we've been watching for a possible downward wave pattern.

Right now, here’s what seems most likely: The market may be entering Wave 3 of the decline, which is typically the most powerful and aggressive part of a downward move. This makes the next bounce super important because Wave 4 can’t go back up into where Wave 1 was.

This rule tells us the single most important level in the whole market right now.

The Key Level: $3.25 Trillion

Here’s what it all boils down to:

If the total crypto market cap gets back above $3.25 trillion, the bullish trend is still on.

If it stays below $3.25 trillion, the downward trend will probably keep going.

This level tells us almost everything about the bigger picture. It's the point that shows if the bull run will continue or if prices will fall even further.

Conclusion

The next big crypto trend relies on whether we stay above or below $3.25T.

Above it? The bullish trend might come back.

Below it? The downward trend gets stronger.

Keep an eye on the overall structure – the market is showing us where the next big move is headed.