Crypto trading can feel like a rollercoaster: exciting, fast-paced, and sometimes overwhelming. If you’re new to trading or testing out a new strategy, jumping in with real money can be risky. That’s where paper trading comes in.

Paper trading lets you practice buying and selling crypto without actually putting your money on the line. Think of it as a simulator where you can test strategies, learn to understand the market, and gain confidence before stepping into real trades.

In this article, we’ll break down what paper trading is, why it’s valuable, and how you can use it to sharpen your trading skills.

What is Crypto Paper Trading?

Paper trading crypto is the practice of simulating trades using virtual money instead of real funds. The term “paper” comes from the old days when traders used pen and paper to record hypothetical trades to see how they would play out.

Today, most crypto exchanges and trading platforms offer built-in paper trading features that mimic real market conditions. You’ll see live prices, charts, and order books—just like real trading—but your balance is filled with pretend money.

So, while you don’t profit or lose anything financially, you still experience how your trading decisions would perform in the real market.

Why is Paper Trading Important for Crypto Traders?

Paper trading isn’t just for beginners—it’s useful for anyone looking to improve their trading game. Here’s why:

1. Risk-Free Practice

The crypto market moves fast. Without experience, it’s easy to make impulsive mistakes. Paper trading gives you a safe space to learn without the fear of losing real money.

2. Test New Strategies

Even seasoned traders use paper trading to experiment. Whether you’re trying a new day trading strategy, testing swing trades, or checking how an indicator works, paper trading lets you see results before committing real funds.

3. Build Confidence

Trading psychology is a huge part of success. Beginners often panic when they see red candles or sudden dips. Practicing in a paper trade environment helps you understand market behavior and build emotional discipline.

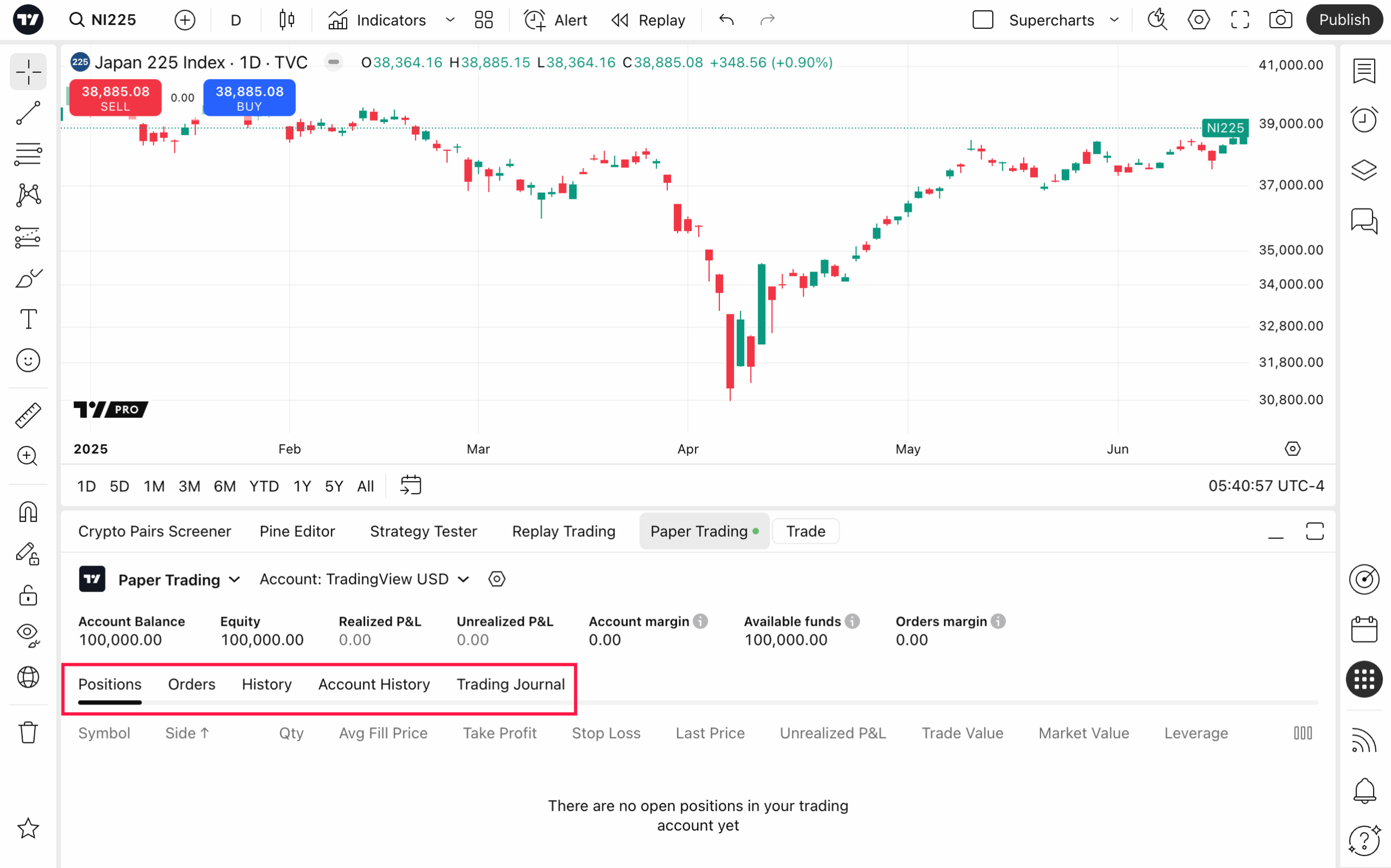

4. Learn Platform Tools

Crypto exchanges can be overwhelming with all the charts, indicators, and order types. Paper trading helps you get comfortable with the tools so you don’t misclick and place the wrong trade when real money is at stake.

How Does Paper Trading Crypto Work?

The process is simple, and most platforms follow the same steps:

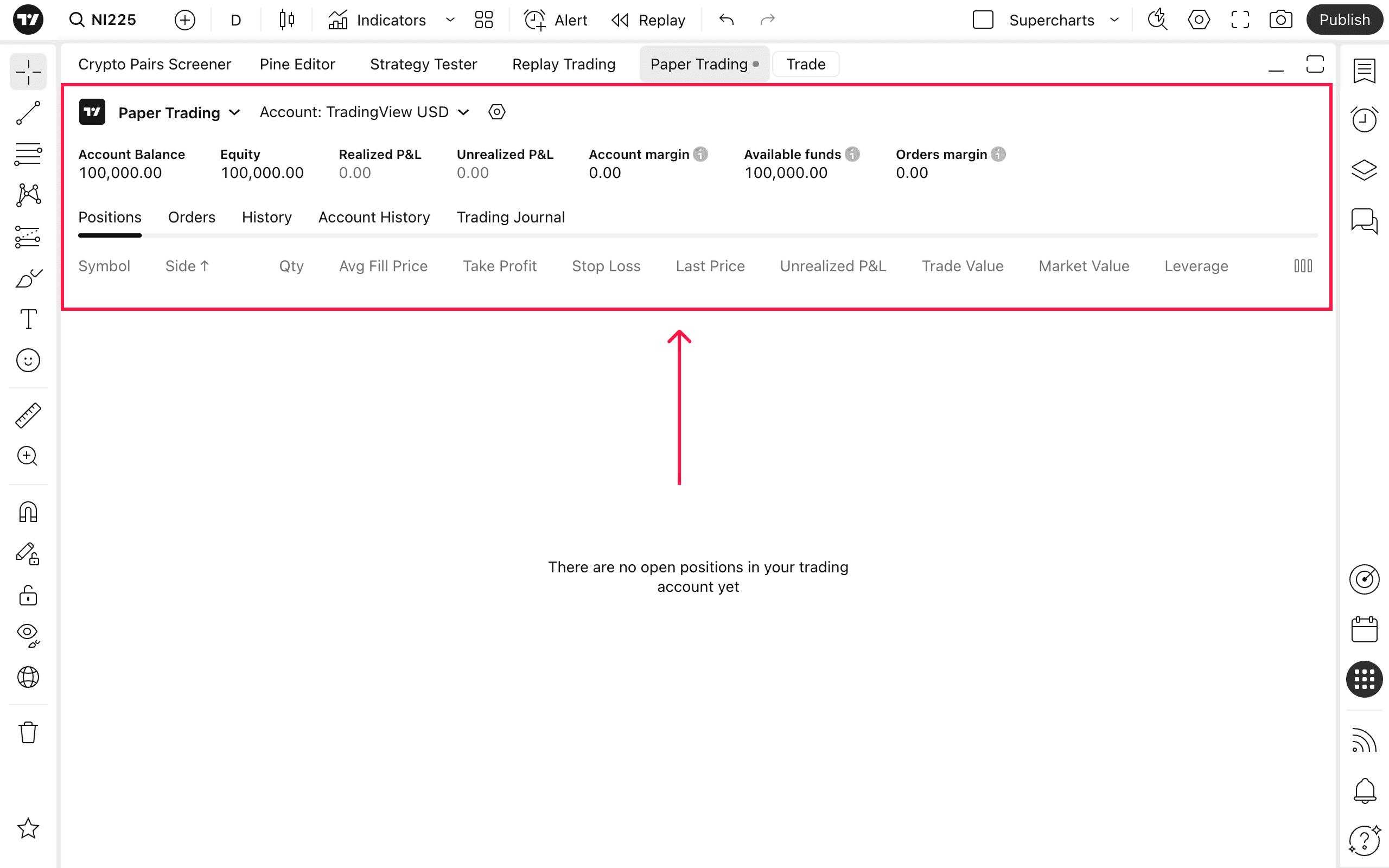

1. Create a Paper Trading Account

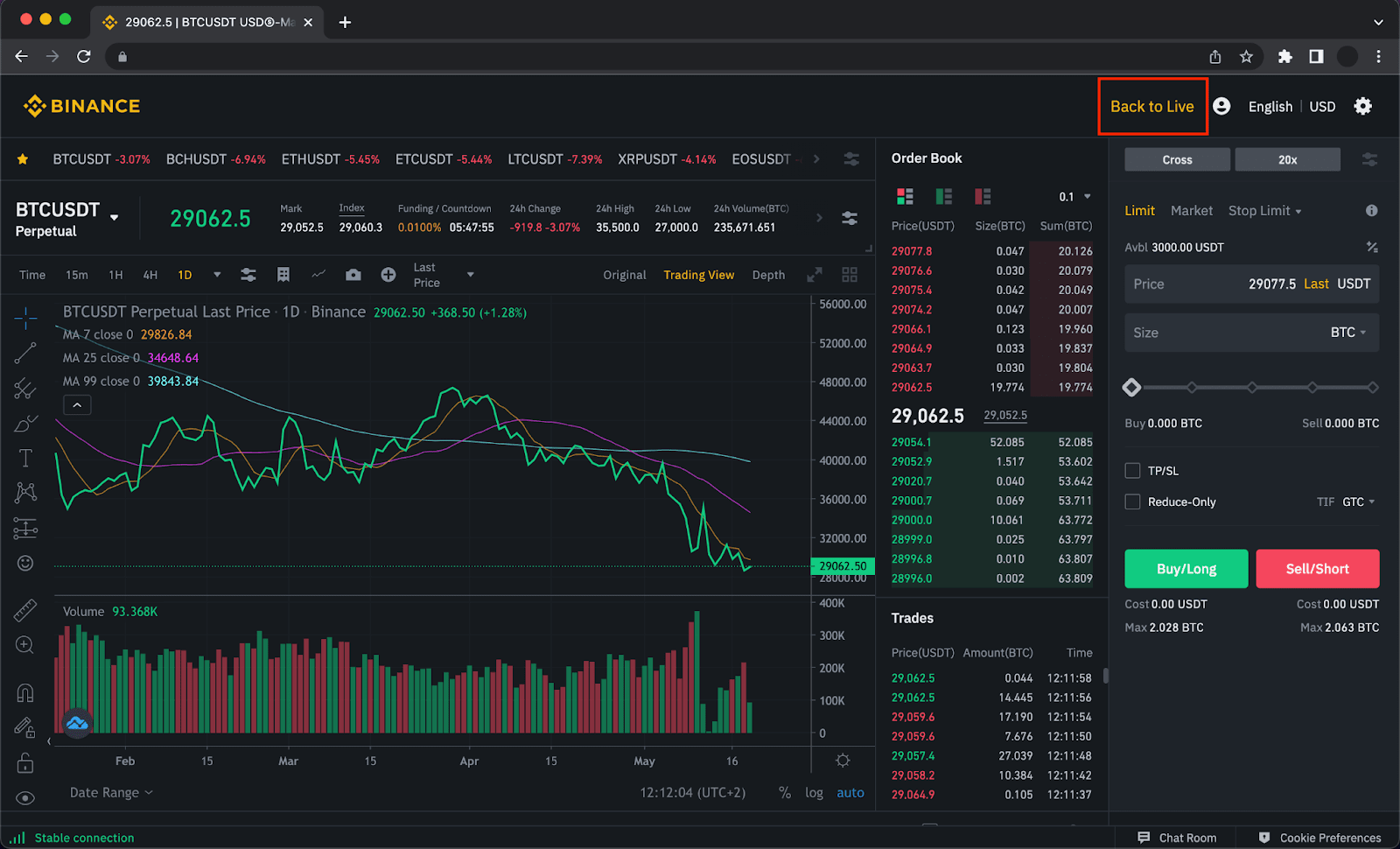

Many platforms (like TradingView, Binance, or Bybit) have paper trading modes. You’ll often get a virtual balance (say $100,000 in demo funds) to start with.

2. Pick a Crypto to Trade

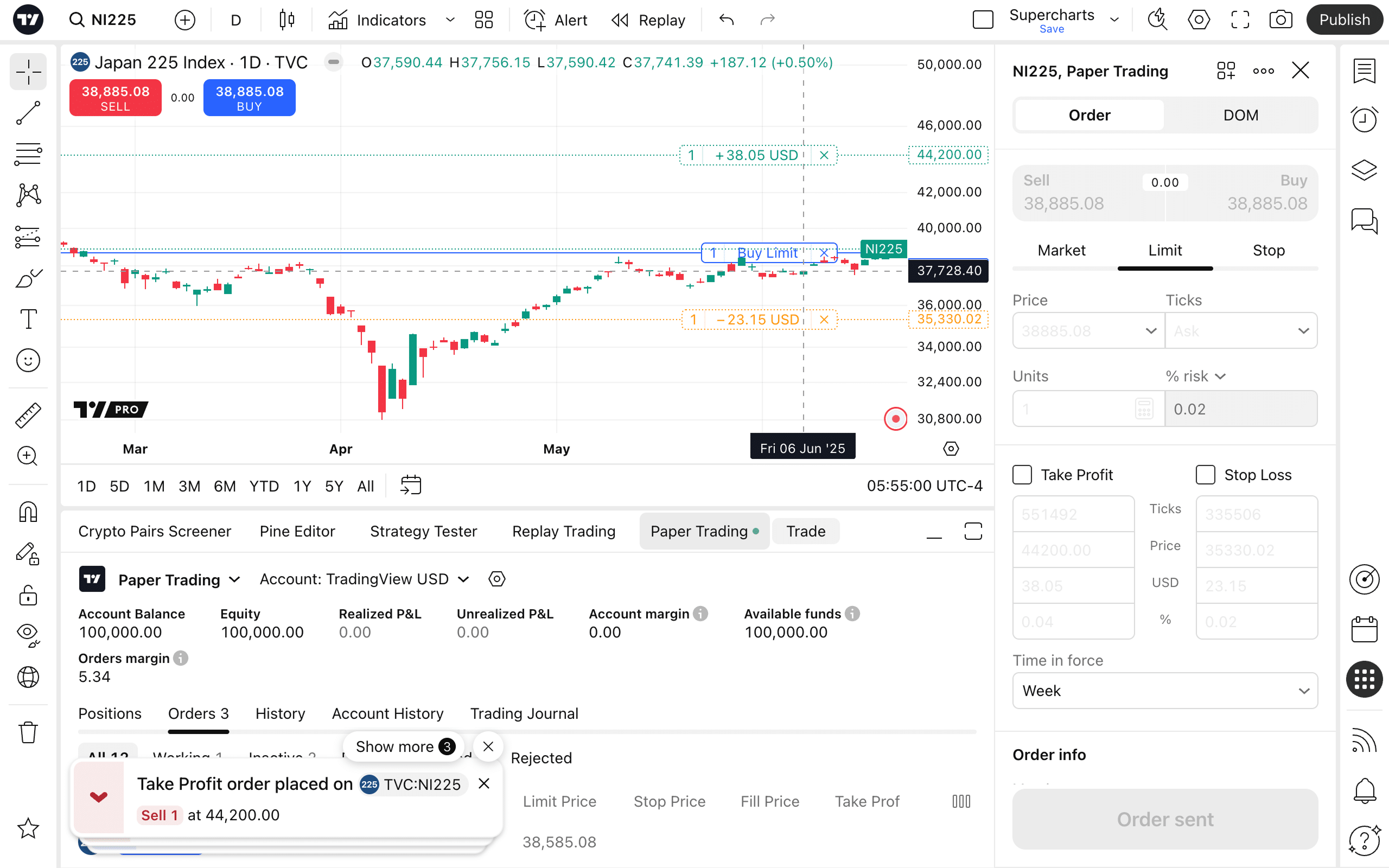

Choose from popular coins like Bitcoin, Ethereum, or even smaller altcoins. Prices mirror real-time market data.

3. Place Trades

Just like with real trading, you can place market orders, limit orders, and even set stop losses.

4. Track Performance

Watch how your strategy plays out. Did you buy too early? Sell too late? Paper trading helps you analyze mistakes without financial pain.

Best Platforms for Crypto Paper Trading

If you’re ready to try it out, here are some popular options:

TradingView – A favorite among traders. It offers paper trading with real-time data and advanced charting tools.

Binance – Provides a testnet (demo trading environment) where you can practice with virtual funds.

Bybit & Bitget – Known for futures and derivatives trading, they also offer demo accounts to practice advanced strategies.

eToro – A beginner-friendly platform with social trading features and a virtual trading account.

Tips to Get the Most Out of Paper Trading

Paper trading can be an amazing learning tool, but only if you use it correctly. Here are some best practices:

1. Treat It Like Real Trading

Don’t go crazy placing trades you’d never do with real money. The goal is to develop discipline, so act as if every trade counts.

2. Set Clear Goals

Are you practicing day trading? Swing trading? Long-term investing? Define your approach before you start so your results are meaningful.

3. Track Your Trades

Keep a journal. Note why you entered a trade, where you set your stop loss, and what outcome you expected. Reviewing your decisions will help you improve.

4. Gradually Transition to Real Trading

Once you see consistent results in paper trading, start small with real money. Even $50–$100 can give you a feel for the emotional side of trading, which paper trading can’t fully replicate

Limitations of Crypto Paper Trading

While paper trading is an amazing tool, it’s not perfect. Here’s what to keep in mind:

No Real Emotions: When real money is on the line, emotions like fear and greed can cloud your judgment. Paper trading can’t simulate that fully.

Liquidity Differences: In real trading, large orders may not always fill instantly. Paper trading often assumes your order executes without slippage.

Overconfidence: Just because you’re winning in paper trades doesn’t guarantee success with real money. Use it as practice, not a promise.

Final Thoughts

Crypto paper trading is one of the smartest ways to learn and practice trading without the risk of losing money. Whether you’re a beginner learning the basics or an experienced trader testing a new strategy, paper trading lets you gain experience, refine techniques, and build confidence.

Remember, the goal isn’t just to win trades on a demo account—it’s to prepare yourself for the real-world emotions and risks of live trading. Use paper trading as your training ground, and once you’re ready, take those lessons into real trades step by step.