What Is Uniswap (UNI)?

Uniswap is one of the most recognized decentralized exchanges (DEXs) in the cryptocurrency world. Launched in 2020, it revolutionized decentralized trading by introducing an automated market maker (AMM) model that replaced traditional order books.

This innovation allowed users to swap tokens instantly and provide liquidity to earn fees — all without intermediaries. The 2020 airdrop to early users remains one of the most legendary events in crypto, establishing UNI as both a governance token and a participation mechanism for the Uniswap ecosystem.

How Uniswap Improved DeFi Trading

Before Uniswap, decentralized exchanges had problems. They didn't have enough money and weren't easy to use. Uniswap changed this with its special pools. These pools made it easy to trade tokens simply, or earn money by adding tokens to the pools.

Because it was so simple, open, and reliable, Uniswap quickly became popular in DeFi. It became the main place for trading tokens, which really helped make DeFi grow.

Competition Heats Up: PancakeSwap and the DEX Landscape

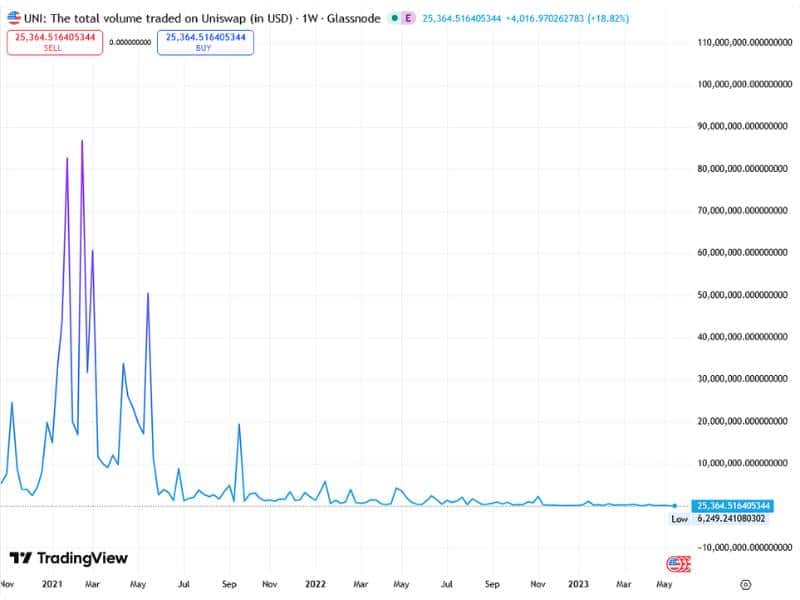

Uniswap's been seeing a lot of competition lately. PancakeSwap, which runs on Binance Smart Chain (BSC), is now responsible for almost half of all decentralized exchange (DEX) trading.

This change shows that Binance Smart Chain is making a comeback and that the DEX market is getting really competitive. Uniswap is still a strong second place, with a lot of users trusting it, but it needs to find new ways to get back to the top.

Why Uniswap is Still a Top DeFi Platform

Even with many DeFi platforms around, Uniswap is still a favorite. It's had a big impact on how decentralized finance has grown.

Uniswap runs smoothly on Ethereum, Arbitrum, and Optimism. This support is useful because more people are using these platforms. Being on different chains means there's plenty of money available, making trading easy no matter what the market is doing.

People like Uniswap because it’s simple. It’s easy to use whether you're swapping tokens, trading, or adding funds to earn. If you add funds, you get a share of the fees that traders pay. Keep in mind that prices can change quickly, which can lead to impermanent loss – a common risk in DeFi. People often choose stablecoin pools to reduce risk. They offer steady, but smaller returns, which is a safer way to start.

Uniswap is popular for being reliable, easy to use, and well-known. This keeps attracting users, both those who are experienced and those who are just starting out.

What You Should Know About UNI Token and Uniswap

UNI is Uniswap's governance token. If you hold UNI, you get to vote on changes to the platform. There's a limit of 1 billion UNI tokens total, and about 630 million are out there now. This limit could make each token more valuable as more people use Uniswap.

UNI's value comes from Uniswap's good name in theDeFi world. People know Uniswap for being open and fair, which makes UNI look good too.

DeFi and online trading are getting bigger, so UNI could become quite valuable. It has a limited supply, lots of people use it, and it's known as reliable. All these things make it valuable.

Can Uniswap (UNI) Actually 5x by 2025?

Is it realistic for Uniswap (UNI) to increase fivefold by 2025? Here's what needs to happen:

1. Ethereum and Layer-2 Growth

UNI relies on Ethereum and its layer-2 solutions. If networks such as Arbitrum and Optimism succeed, UNI stands to gain.

2. Making Uniswap More Attractive

Uniswap needs to give users compelling reasons to choose it over other choices. Competitors like PancakeSwap provide more than just token swaps. They keep users engaged with staking, farming, lotteries, and token burning. Uniswap could draw in new users by including ways to earn or changing its token system.

3. The Potential of a DeFi ETF

A DeFi ETF could bring big changes. If an ETF holds prominent DeFi projects like Aave, Maker, and Uniswap and gets a lot of investment, UNI might reach $45 or more.

If Ethereum keeps growing, Uniswap improves, and investments rise, Uniswap should remain a major player in DeFi. UNI has good growth potential if conditions are right.

UNI Price Forecast: Could It Really 5x?

Just getting back to $20 from where we are now would be great. But, if the UNI system keeps growing, new ideas come out, and bigger investors jump in, UNI might hit $40–$45. If that happens, you could see your investment increase five times over in this bull market.

In Conclusion: Is Uniswap Still a Good DeFi Investment?

Uniswap is still a very popular and well-regarded decentralized exchange in the crypto world. Even though there are more competitors now, it's still important because it works across many different blockchains, has a strong reputation, and has reliable technology.

If Uniswap changes with new token systems or ways to reward users, and if Ethereum keeps doing well, UNI could again be a top DeFi investment in the 2025 cycle.