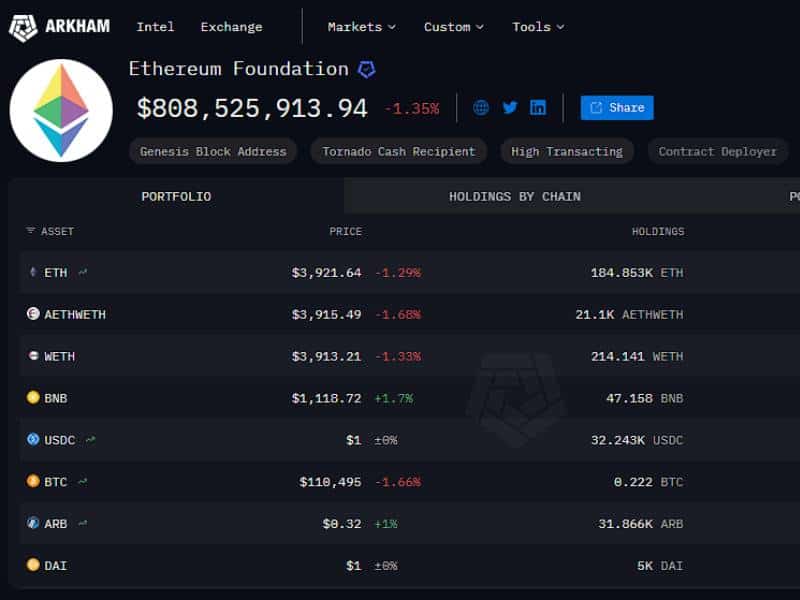

The Ethereum Story: What About That $650 Million?

There's been talk recently that the Ethereum Foundation might be connected to wallets containing over $650 million in ETH. Wallets that have been used for selling in the past.

That's a lot of money! Some people might worry that this is bad for Ethereum. But before we jump to conclusions, let's check out the details. What might seem like a bad choice could actually be a sign of smart moves going on beneath the surface.

A Look at How the Ethereum Foundation Manages Its Wallets

The Ethereum Foundation has experience in handling its money wisely. Big transfers aren't knee-jerk reactions, rather they're planned moves to help the network keep growing.

They often move ETH between wallets to:

Pay for research and development

Give grants to projects in the ecosystem

Handle large, private sales with big partners

For example:

A recent transfer of 10,000 ETH (about $40 million) paid for current development work.

Another 10,000 ETH went through a private sale with a partner. This deal didn't change the price on public exchanges.

So, while these transactions get attention, they're usually just regular business, not a sign of selling off holdings.

Big Crypto Moves: What They Really Mean

Big crypto transfers can seem scary, like the market's about to crash. But on-chain data doesn't tell the whole story.

Large wallets move crypto for many reasons, such as managing money or making internal adjustments. These moves don't always mean a price drop is coming.

The media often makes things worse with alarming headlines like:

“Foundation selling!”

“Ethereum crash incoming!”

These headlines get attention but often lack the full context. Ethereum remains solid, with its price holding around $3,000, a level that's been tough to break through before.

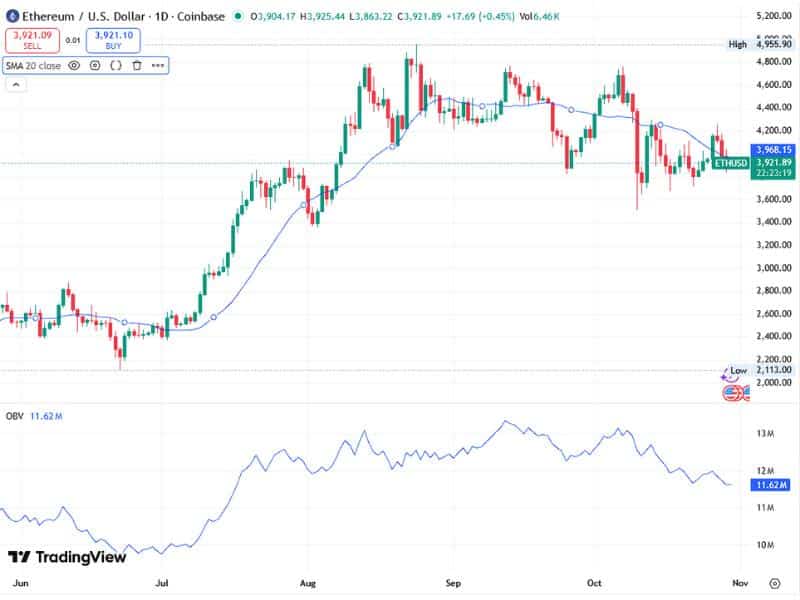

Ethereum's Technical Outlook: Still Looking Good

Ethereum's chart still looks encouraging.

On the long-term charts, ETH is in what's called a falling broadening wedge. This usually means that once things change, the price will likely go up.

If we look closely, the price is still finding support in a zone where it has been since early last year.

Each time the price moves up from this area, a breakout becomes increasingly possible.

It's worth noting that we saw something like this in 2019, right before Ethereum's big price increase. Back then, false rallies, sudden drops, and worry created doubt just before the price jumped.

The Emotional Cycle of Markets: Where We Are Now

Every cycle follows the same emotional pattern:

- Fear near the bottom

- Disbelief during recovery

- Euphoria at the top

Right now, Ethereum appears to be in that disbelief phase again, where investors question every move just before momentum shifts bullish.

The data and technicals point toward accumulation, not collapse. Wallet transfers are part of Ethereum’s long-term operational rhythm, not warning signs.

Key Points: Smart Data Use

Even with the market's ups and downs, Ethereum is holding steady, and the Ethereum Foundation is in good shape financially.

Because the crypto market is so changeable, investors should keep calm, stick to their strategies, and pay attention to the data. A level head can be a real asset.

Keep informed, prepare for shifts, and watch where things go.