If you’ve dipped your toes into crypto trading, you already know it’s not just about buying Bitcoin and waiting for the price to rise. The market is 24/7, highly volatile, and filled with endless opportunities—and risks. That’s where crypto trading software and tools come in.

The right tools help you track the market, spot trends, and make smarter decisions. Think of them as your trading toolkit: charts to understand patterns, apps to monitor your portfolio, and even bots that execute trades while you sleep. Without them, trading feels like flying blind. With them, you’re better prepared to navigate the ups and downs of the market.

Types of Crypto Trading Tools You Should Know

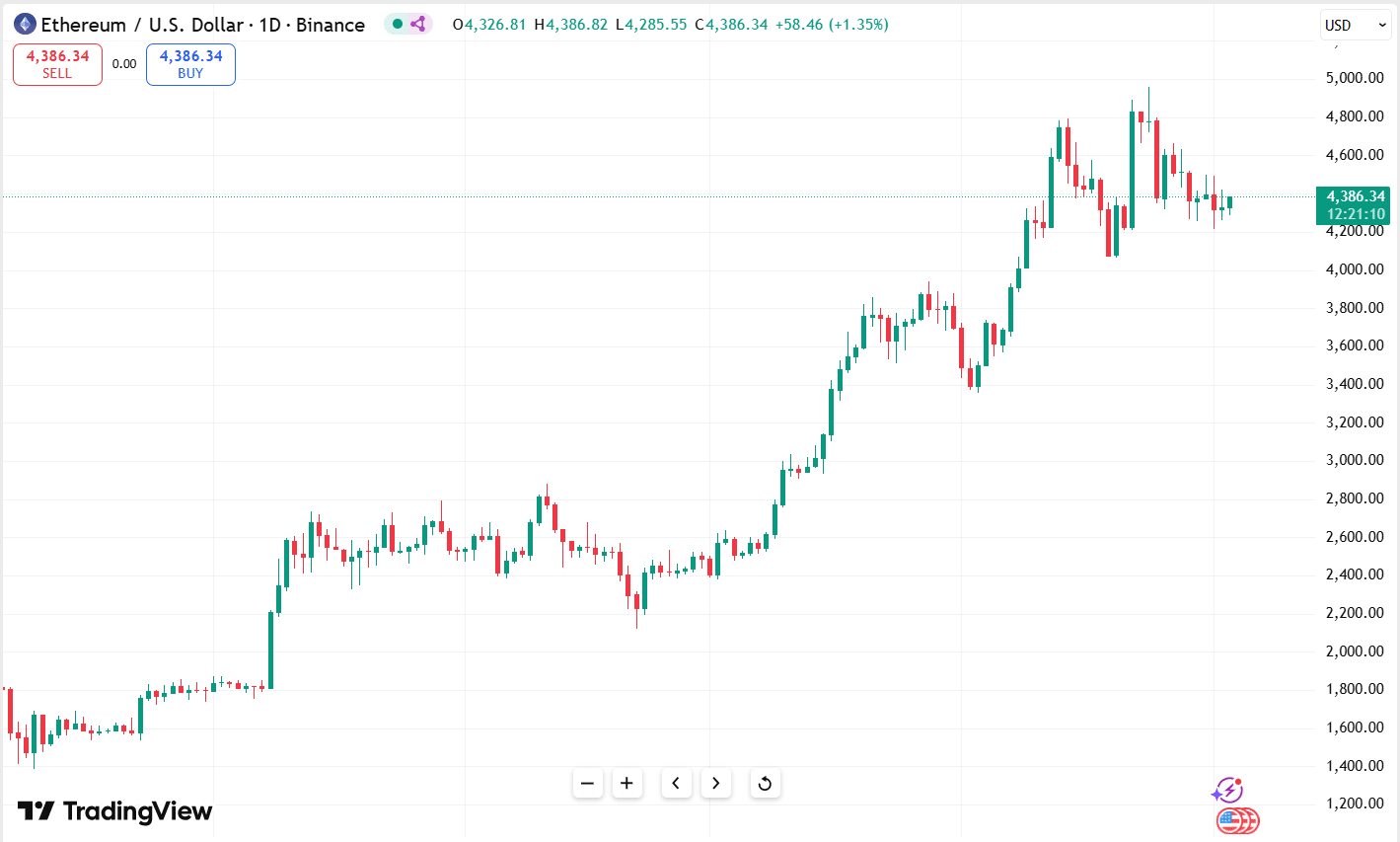

- Charting and Analysis Tools

Charts are the bread and butter of any trader. Platforms like TradingView give you detailed price charts, drawing tools, and indicators like RSI, MACD, and moving averages. These tools help you figure out whether it’s a good time to buy, sell, or just wait. - Portfolio Tracking Software

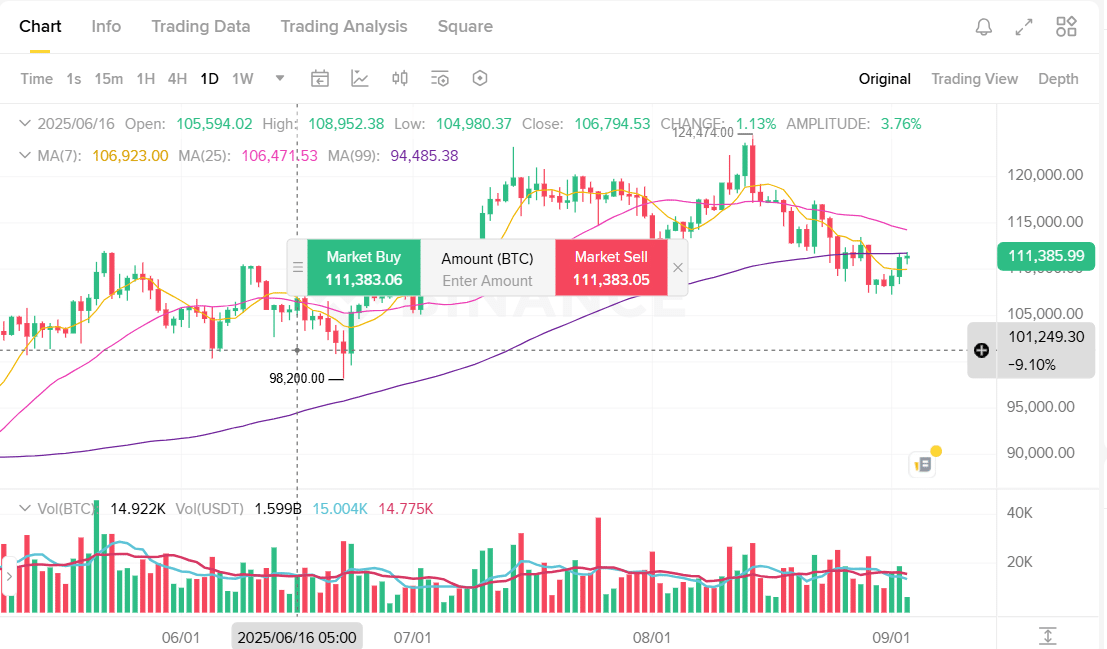

It’s easy to lose track when you own multiple coins across different exchanges. That’s where portfolio trackers like CoinStats or Delta come in. They let you see your entire crypto portfolio in one place, track profits and losses, and even set alerts. - Crypto Trading Bots

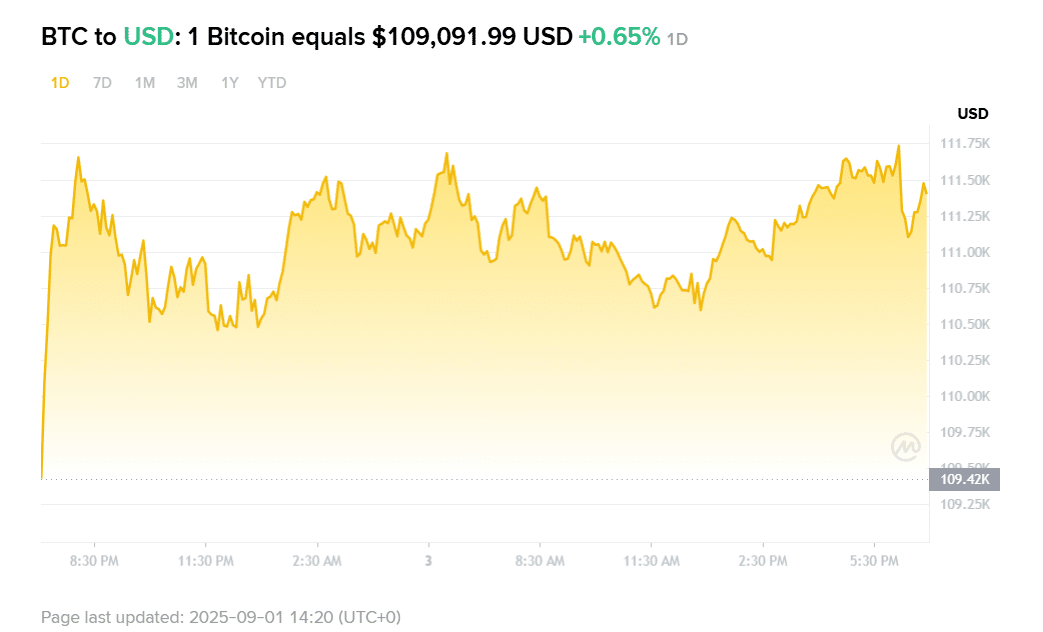

If you don’t want to stare at screens all day, bots can help. Crypto trading bots are pieces of software for crypto trading that automatically execute trades based on pre-set rules. For example, you can set a bot to buy Bitcoin if the price drops 5% and sell it when it rises 10%. Popular choices include 3Commas and Pionex. - News and Sentiment Tools

In crypto, news can move markets within minutes. Tools like CryptoPanic or LunarCrush track the latest headlines, tweets, and market sentiment. Staying updated helps you avoid surprises and even catch opportunities before others. - Risk Management Tools

Managing risk is just as important as chasing profits. Stop-loss orders, take-profit features, and position sizing calculators fall into this category. Most exchanges like Binance and Coinbase provide built-in crypto trade tools for this purpose.

How to Choose the Right Crypto Trading Software

With so many options out there, choosing the right software can feel overwhelming. Here’s a quick checklist to guide you:

- Ease of Use: If you’re a beginner, start with user-friendly platforms. Complicated dashboards can overwhelm you.

- Features: Decide what you need most—charting, automation, portfolio tracking, or risk management.

- Security: Always prioritize platforms with strong security measures like two-factor authentication.

- Cost: Many tools are free, but advanced versions often require a subscription. Make sure the benefits outweigh the cost.

Benefits of Using Crypto Trading Tools

- When you use the right software for crypto trading, you:

- Save time by automating repetitive tasks.

- Make better-informed decisions based on real data.

- Track your performance across different coins and exchanges.

- Manage risk more effectively, avoiding costly mistakes.

- These benefits add up, helping you trade smarter—not harder.

Common Mistakes to Avoid with Crypto Trade Tools

- While these tools are powerful, they’re not magic bullets. Here are some pitfalls to watch out for:

- Over-Reliance on Bots: Bots can’t predict sudden market crashes or hacks. Always monitor your settings.

- Ignoring Risk Management: Tools are helpful, but if you skip stop-losses or invest more than you can afford, no software can save you.

- Chasing Every Tool: Don’t clutter your setup with dozens of apps. Focus on a few that really meet your needs.

- Pro Tip: Start with free versions before committing to premium subscriptions. Test how they fit into your trading routine.

Final Thoughts

Crypto trading can feel overwhelming, but with the right tools and software, you’ll have a serious edge. From charting platforms to bots, portfolio trackers, and sentiment analyzers, these tools are designed to make you more efficient and informed.

Remember, no tool guarantees profits—but they can help you avoid common mistakes and trade with confidence. Whether you’re a beginner or looking to step up your game, mastering crypto trading software is a key part of your journey.