The crypto market is changing a lot as 2026 begins. More big companies are jumping in, we're getting clearer rules, and blockchain is getting better fast. To make sure your crypto investments do well, you have to look past the hype.

To build a good crypto portfolio in 2026, you need to think about the basics, how crypto is being used in the real world, and how well your assets will do, no matter what the market is doing. Here’s how to build a portfolio that balances being safe, growing your money, and staying updated on what’s new in crypto.

Bitcoin (BTC): Why It Should Be 30% of Your Crypto Portfolio in 2026

Bitcoin remains the most dependable crypto asset. Its worth is clear every time the market shifts. Big institutions are buying it up, companies are including it in their financial strategies, and politicians are talking about it in discussions about global money.

These developments have changed how people think about Bitcoin. Now, it's seen as a long-term defense against money losing value and increase of money, not just a quick investment. Its limited supply, ease of trading, and years of history give it a stability that other cryptos haven't achieved yet.

When investing in Bitcoin, how long you hold it is more important than when you buy it. Keeping Bitcoin for the long haul has proven more rewarding than trying to time the market. Its ability to hold its own during economic ups and downs is why it's the core of this portfolio.

Because of its stability and increasing acceptance among institutions, Bitcoin makes up around 30% of the 2026 crypto portfolio. It acts as the base for the rest of this plan.

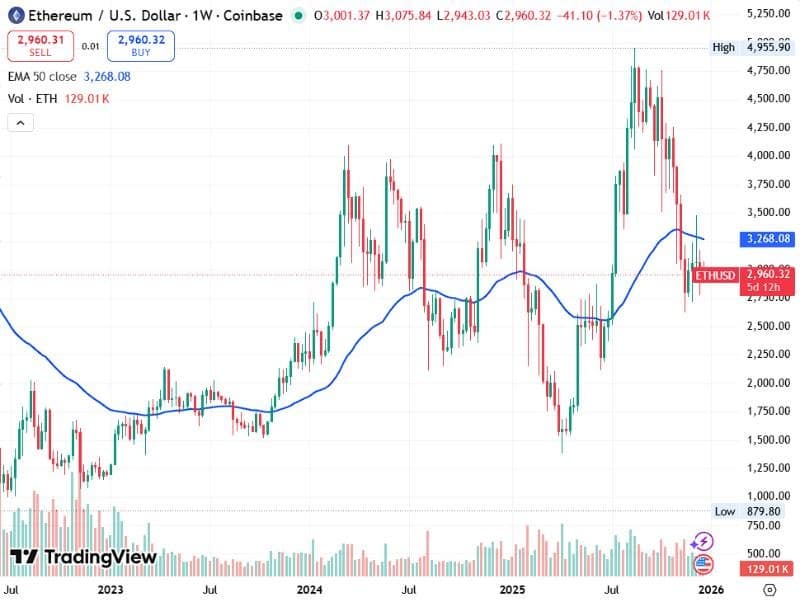

Ethereum (ETH): The Foundation (20%)

Ethereum is still the main support for decentralized apps. Lately, the network has put a lot of effort into things like improving speed and better transaction handling.

These changes have made things much easier to use, and Ethereum is still the go-to place for DeFi, NFTs, token platforms, and company blockchain apps. Big institutions want more Ethereum because it acts like a financial base that can be programmed, not just a basic digital coin.

Because Ethereum is so important to the crypto world, it gets 20% of this 2026 portfolio. It's the main base that keeps everything running.

Sui (SUI): Layer-1 Growth at 20%

Sui, a layer-1 platform, is growing and should keep doing so through 2026. Its tech works well, giving quick transactions, fast speeds, and a simple setup for developers.

The Sui network balances payment systems, stablecoins, games, and apps that need quick response times and handle lots of action. The team’s skill in getting things done sets Sui apart, no matter what the market is doing.

Sui is 20% of this portfolio because of its tech, user activity, and progress, making it a fast-growing part of the plan.

Bittensor (TAO): AI Meets Crypto (15%)

AI is hot right now, and its combination with blockchain tech is gaining attention. Bittensor is testing out this idea in an innovative way.

Instead of normal mining, Bittensor rewards networks that put out quality AI. The main thing is the useful machine learning results. This sets up a scene where AI models work together and get better because of monetary rewards.

Since AI is being used more and more, having some investment in a crypto AI network is a good idea. Bittensor will take up 15% of this 2026 portfolio. This shows just how important decentralized AI could become.

Why Ondo Finance (ONDO) Matters: Tokenizing Real-World Assets (15%)

Tokenizing real-world assets is quickly changing from a small idea to something big institutions are watching closely, and Ondo Finance is right in the middle of it. Because traditional finance people are searching for ways to use blockchain tech without going against the rules, being able to put regular assets on the blockchain is getting more and more helpful.

Ondo is really good at concentrating on tokenized treasuries, bonds, and products that pay yield, which are similar to what institutions already know and trust. Instead of changing finance completely, Ondo works as a link—connecting regular markets with blockchain setups in a way that seems doable, follows the rules, and can grow bigger. This method is especially good since there's more need for crypto-based yield that's supported by real-world assets instead of just guessing.

Putting Ondo Finance in this portfolio means getting direct access to one of the quickest-growing ideas in crypto that institutions care about. A 15% part shows both the chance in tokenizing real-world assets and what Ondo can do as this trend keeps going into 2026 and later.

Our Crypto Portfolio Picks for 2026

Here's how we're thinking about our crypto investments, mixing stable choices with tech and trends:

- Bitcoin (BTC): 30% – It's here to stay as reliable and valuable.

- Ethereum (ETH): 20% – Still a top platform for many applications.

- Sui (SUI): 20% – A fast, growing system that's worth watching.

- Bittensor (TAO): 15% – Our way to invest in decentralized AI tech.

- Ondo Finance (ONDO): 15% – It's about bringing real-world assets into crypto.

Every crypto here has a strong base, is being developed, and has support from institutions or real applications. We’re focusing on dependable, understandable options instead of risky bets. This approach should work well for anyone planning for 2026 and beyond.