Introduction: Bitcoin’s Next Big Move

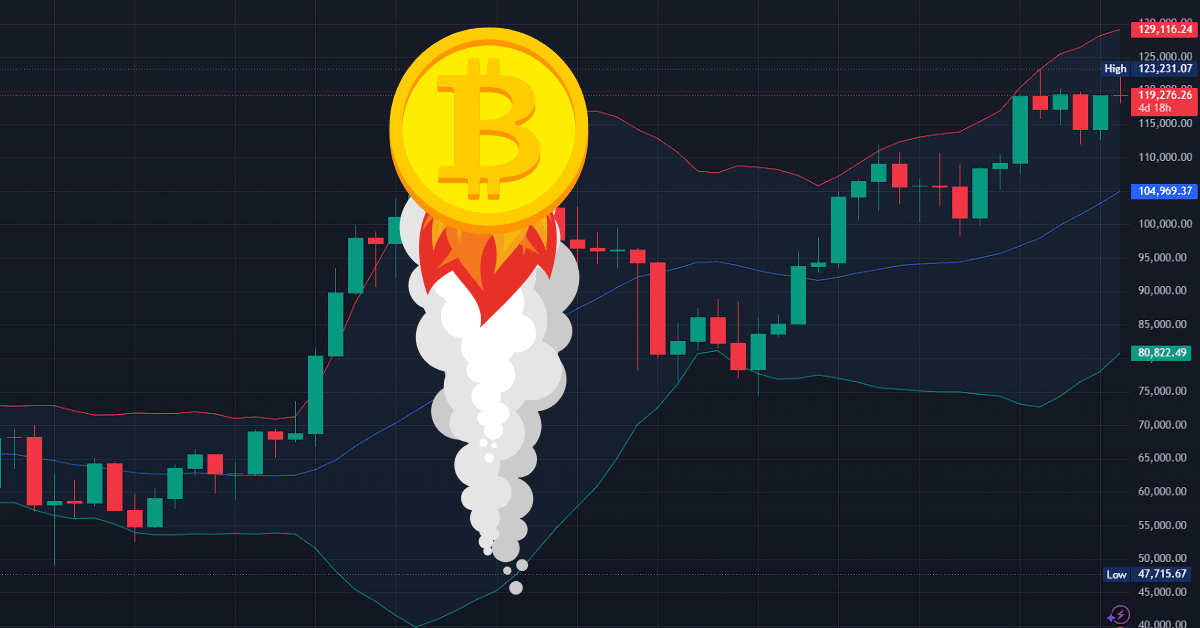

Bitcoin is evolving, and the old four-year cycle might be coming to an end. Increasing institutional adoption is bringing more permanent holders into the market, solidifying Bitcoin’s position as a critical financial asset. Predictions are bullish, with forecasts ranging from $120K to $250K by the end of the year, especially if major players like the U.S. government start acquiring Bitcoin.

The Rise of Stablecoins and Tokenization

Stablecoins have really opened the door to some exciting possibilities in crypto. They let us take everyday things—like stocks, real estate, or other assets—and turn them into digital tokens on the blockchain. Bitcoin is awesome as digital gold, but it can’t handle the complex contracts needed to do this kind of tokenization. That’s where Ethereum comes in. It’s built to run smart contracts, which are like digital agreements that automatically make sure everything happens the way it should. Thanks to Ethereum, tokenizing assets is safer and easier than ever, and it’s starting to change how we think about owning and trading things.

Tom Lee’s Take: Why the V-Shaped Rally and Skepticism Actually Work in Our Favor

Tom Lee, a well-known market expert, talks about what is known as a “V-shaped rally.” It’s when the market takes a big drop, but then bounces back really fast. Now, a lot of people are still doubtful about whether this bounce will last or if it’s just a short blip. But here’s the interesting part: Lee says that skepticism can actually be a good sign. When people aren’t too sure, it means the market hasn’t fully priced in all the good news yet. So, there’s still room for some nice surprises. This is happening both in traditional stocks and in crypto, especially Bitcoin.

Bitcoin Is Becoming Digital Gold — Quietly But Surely

Bitcoin isn’t making a lot of noise, but it’s quietly hitting new highs and becoming the digital version of gold. Big companies like MicroStrategy have been steadily buying and holding onto Bitcoin; they’ve accumulated about 600,000 coins since 2020. To put it simply, it’s like how ExxonMobil stockpiled oil reserves back in the ’80s. It was a smart move that gave them a huge advantage. That’s exactly what these companies see in Bitcoin: a valuable asset that could pay off big time in the long run.

What Happens When Big Players Start Buying Bitcoin?

More and more banks and big companies are waking up to how rare and valuable Bitcoin really is. They’re adding it to their portfolios, treating it like digital gold. Now, imagine if the U.S. government decided to buy a million Bitcoin, the price would probably shoot through the roof. MicroStrategy’s giant stash of Bitcoin is like a sneak peek of what could happen when more big players jump in. The potential for Bitcoin’s price to soar is very real.

Ethereum’s Role in the Financial Shift

Think about being able to turn things like houses, stocks, or art into digital tokens you can trade or own online. This process, called tokenization, needs smart contracts, kind of like digital agreements that automatically handle all the complicated stuff. Ethereum is the platform that makes this possible. Right now, it’s gearing up for a big moment, similar to its breakout in 2017, as Wall Street and traditional finance begin to adopt blockchain technology. Ethereum is becoming the bridge that connects the old financial world with this exciting new blockchain future.

Conclusion: Getting Ready for the Financial Revolution

Bitcoin is quietly becoming the new digital gold, a trusted store of value. But Ethereum is where the real innovation is happening, enabling tokenization and smarter ways to handle money and assets. With big institutions jumping in and the technology rapidly evolving, the financial world is on the verge of a major shift. Now is the perfect time to get ready for what’s coming next.