Making Sense of the Altcoin Market's Moves

If you're into crypto, you've likely seen the market fluctuate. Usually, Bitcoin is the first to get attention and investment. Once Bitcoin's momentum slows, Ethereum's price tends to rise as people seek higher returns. After Ethereum, investors often turn to altcoins, which can lead to big price increases for these smaller coins.

Understanding this pattern can help you make better investment choices. It can prevent you from jumping on trends too soon or sticking with losing investments for too long. Timing your investments with the market's flow can really increase your crypto portfolio. This is especially useful if you're starting with a smaller amount, like $5,000, where each investment is important.

Easy Ways to Create an Altcoin Portfolio

Making an altcoin portfolio requires smart choices and managing risk.

First, be ready to adapt. The crypto market moves quickly, so adjust your investments as things change. Keep an eye on what you own and change your portfolio when you need to.

Second, find ways to get more coins. Staking, providing liquidity, and yield farming can help you grow your holdings.

Third, avoid being too greedy – take profits along the way. Waiting for the highest price might mean losing out if prices drop.

One good idea: Keep some cash available. Use it to buy when the market dips, instead of selling out of fear.

Building an Altcoin Portfolio with $5,000

When you only have $5,000 to invest, it's best to keep things simple. A straightforward and balanced plan can help you get good returns while managing risk. I like to divide a portfolio into three parts: core holdings, mid-size projects, and high-risk investments. Each part helps balance stability, growth, and risk.

Here’s how I’d break it down: Put $2,500 (50%) in core holdings, $1,500 (30%) in mid-cap altcoins, and $1,000 (20%) in higher-risk investments. This gives you a solid base, good growth potential, and some exposure to plays with big potential. The idea is to focus on the right kinds of assets that fit together well, rather than spreading your money across too many coins.

Why Ethereum is Still a Key Investment

Ethereum is still the top altcoin and a solid base for any serious investment collection. In the past, Ethereum has often done better than Bitcoin when altcoins are doing well. It's a leader in DeFi, NFTs, and Layer-2 solutions, which means it's here to stay and has room to grow. With the Ethereum 2.0 upgrades being introduced, ETH is even more important as a foundation for your investments.

Besides Ethereum, including one or two other strong, big projects can help diversify your base. These could be coins related to popular areas like AI or DeFi. By focusing on Ethereum and a couple of other important coins, investors can ensure stability while still having the chance for growth in the next bull market.

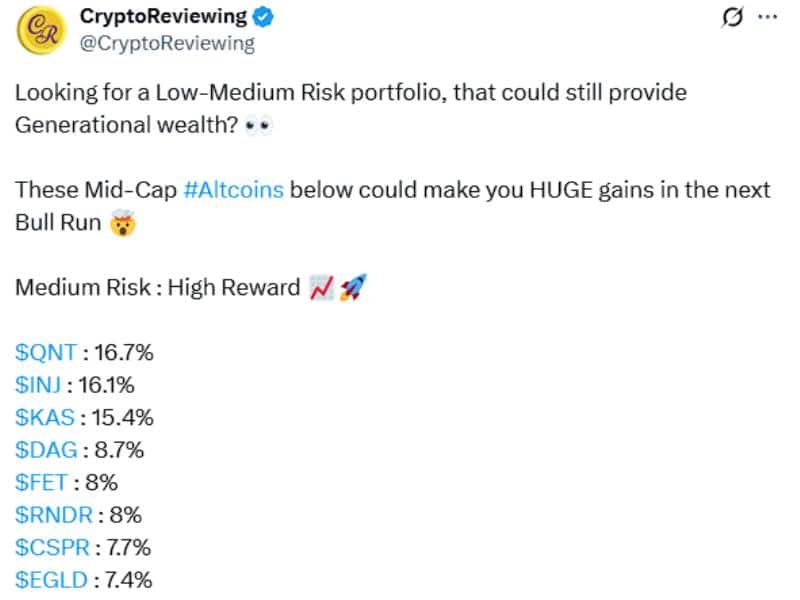

Should You Pay Attention to Mid-Cap Cryptos?

Bitcoin and Ethereum are solid choices for any investment plan. But what about mid-cap cryptos? When things are going well in the market, and after Ethereum has had a good run, these coins can really take off. Usually, they are tied to reliable blockchains, useful tech, or well-liked DeFi platforms. They are a safer bet than those tiny, unheard-of coins, but they can still grow quicker than big names like ETH or BTC.

Many investors don't give mid-cap cryptos much thought. They don't get as much attention as Bitcoin, and they are not as exciting as those super-small coins. Still, mid-cap coins are worth considering. They're strong enough to withstand market downturns but still small enough to experience big gains as more people invest in them. Adding some mid-caps to your investments could really improve your returns.

Moonshot Altcoins: Should You Take the Chance?

Moonshot altcoins are risky, so think of them as calculated bets. It's a good idea to do your homework before picking any coin.

If you're considering this, think about putting about 20% of your crypto funds—say, around $1,000—into it. Then, divide that among three or four smaller projects. If things work out, you could see returns of 10, 20, or even 50 times what you put in. The cool part is, if one of these does well, it can really help your total earnings.

You might lose money sometimes since many small projects don't make it. The key is to spread your money around to lower your risk. Moonshots aren't a sure thing; be ready to lose some. With careful study and balanced investments, you might be able to turn a small amount into something big.

Staking and Compounding: A Crypto Boost

Staking is a cool way to earn in crypto. Lots of altcoins give you yearly rewards, like 5% to 20%, just for holding them. These rewards are nice on their own, but they get really exciting when the market's up. Think about earning staking rewards on a coin that also jumps 5x or 10x in price—that's when your money can really grow fast.

But here's the thing: staking is about finding the right balance. Locking up your coins can get you bigger rewards, but you also want to have some coins that you can easily sell. Crypto markets can change fast, so if all your coins are staked, you might miss out on chances to buy other coins or have trouble selling when prices drop. Keeping a mix of staked and unstaked coins gives you the best of both worlds.

Building Your Altcoin Investment Plan

If you want to invest $5,000 in altcoins, here's a simple plan: Invest $2,500 (50%) in big names such as Ethereum and other popular cryptos. Then, put $1,500 (30%) into mid-cap coins that look like they have a strong base. Lastly, use $1,000 (20%) for riskier coins that could give you bigger returns. This way, you balance safety, growth, and the chance for good profits.

This investment plan is easy to handle for smaller investors. Instead of spreading your money all over the place, this plan keeps things focused. It watches the market and goes for gains you can actually reach. It’s about keeping risks low while still trying to get the most out of the interesting stuff in crypto.

Wrapping Up

You don't have to be rich to get into crypto. A starting investment of about $5,000 lets you build a good mix of stable and growth-focused coins. Make sure to stay flexible, reinvest when you can, take profits sometimes, and keep some cash available. This helps improve your chances of doing well while keeping risks down.

Altcoin booms can happen fast, so it pays to be prepared. The next big surge could be huge, and with a solid plan, even small investors can play the field smart.