Why You Need an Exit Plan

It's easy to think a good market will last forever, but history tells us things change, sometimes quickly. If you don't have an exit strategy, you might get caught up in the excitement and lose your profits. Good planning is key to being a successful investor and not getting stuck with losses.

What's Next for Bitcoin?

We're roughly a year and a half since the last Bitcoin halving, which is when things usually start to heat up. If past patterns hold, Bitcoin might reach its peak in the next six to nine months, possibly hitting around $150,000.

Keep in mind that the Federal Reserve's interest rate moves and happenings around the world could change when this peak actually occurs. It might even get pushed into early next year. The most important thing to remember is that we're getting closer to the market's high point, not just starting the climb.

Bitcoin vs. Altcoins: How the Rotation Works

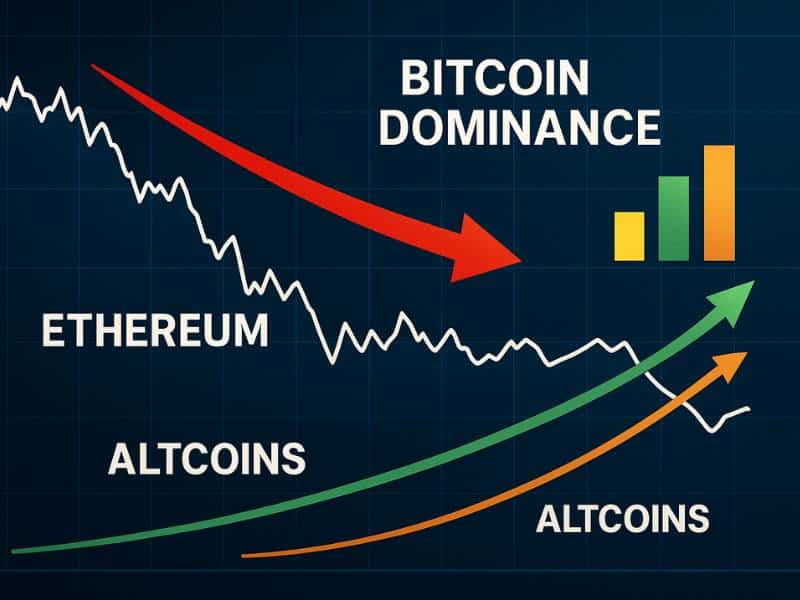

Bitcoin usually starts a bull market. It gets all the attention, brings in new money, and sets the mood for crypto. But when Bitcoin's gains slow down, people start checking out other coins.

Ethereum then usually follows, since investors expect the second-biggest crypto to also go up. After that, money goes into altcoins, letting smaller projects grow quickly.

This pattern looks like it's happening right now. Ethereum is gaining momentum, and Bitcoin isn't as strong as it was. The big altcoin boom hasn't started yet, but it could mean solid profits. Just be careful, things can change fast, and timing matters.

Smart Ways to Cash Out Your Crypto

Let's face it: you're probably not going to sell at the absolute highest point. Trying to time the market perfectly? Forget about it. It's usually a losing game. A much better plan is to sell small chunks over a period. As the market goes up, grab some profits at various points instead of waiting for some major crash.

Consider shifting profits from smaller coins into Bitcoin or stablecoins. This keeps your gains safe but still lets you keep some coins in case they continue to go up.

If you're thinking long-term, keeping most of your holdings in Bitcoin is a solid move. Just don't let the chance of bigger profits make you risk what you've already earned. Selling little by little lets you get the reward.

Handling Your Feelings

Emotions can really mess things up. Usually, when everyone thinks prices will just keep going up, it's a good idea to sell some. History tells us that when the market drops, it happens fast, and people who aren't ready get crushed.

Keep in mind that crypto isn't just about looking at charts. It's about using what you earn to make your life better, like having the money you need, buying a house, or taking care of your family.

The Bottom Line

Investing is a personal thing, but you definitely need a plan for when the market gets rough. Figure out your profit goals up front and stick with them.

It’s tempting to think prices will only rise when things are booming, but that's when you have to stay sharp. Don't let the buzz throw you off track.

This hot market won't last forever. Have a solid exit strategy, so you can cash in big instead of regretting it later.