The crypto market is fast, unpredictable, and full of opportunities. But if you’ve ever sat staring at charts for hours, trying to figure out whether to buy or sell, you know how overwhelming it can get.

If you’ve ever dipped your toes into the world of crypto trading, you already know how overwhelming it can feel. The crypto market is fast, unpredictable, and full of opportunities. Prices swing wildly, charts look like a foreign language, and every Twitter post or Reddit thread seems to offer “the next big thing.” That’s where crypto trading signals come in.

In simple terms, trading signals are like helpful hints or suggestions that guide you when to buy, sell, or hold a cryptocurrency. Think of them as traffic lights on your trading journey—green means go, red means stop, and yellow means caution. For both beginners and experienced traders with limited time, signals can simplify navigating the volatile crypto market.

In this guide, we will explain what crypto signal trading is, how it operates, what to be cautious of, and how you can utilize signals to enhance your trading skills.

What Are Crypto Trading Signals?

Crypto trading signals are recommendations—usually generated by expert traders or automated systems—that guide you on when to enter or exit a trade. They’re often based on technical analysis, market trends, news, or even AI-powered algorithms.

For example, a trading signal for crypto might look like this:

- Buy Bitcoin at $30,500

- Sell Bitcoin at $31,200

- Stop-loss at $30,100

That little snippet gives you a full trading plan: when to get in, when to get out, and where to protect yourself if the market turns against you.

How Do Crypto Signals Work?

Trading signals can come from different sources:

Human Analysts

Experienced traders study charts, patterns, and market news to generate signals. These are often shared in Telegram groups, Discord servers, or through paid memberships.

Automated Bots

Some platforms use bots that scan the market 24/7, crunching data and generating signals based on algorithms.

Hybrid Services

The best of both worlds—expert traders + automation to filter out noise.

Types of Crypto Trading Signals

Not all signals are created equal. Here are the most common types you’ll see:

- Buy/Sell Signals – Simple alerts telling you when to enter or exit a position.

- Stop-Loss Signals – Levels where you should cut your losses to protect your money.

- Take-Profit Signals – Target prices where you should cash out some or all of your gains.

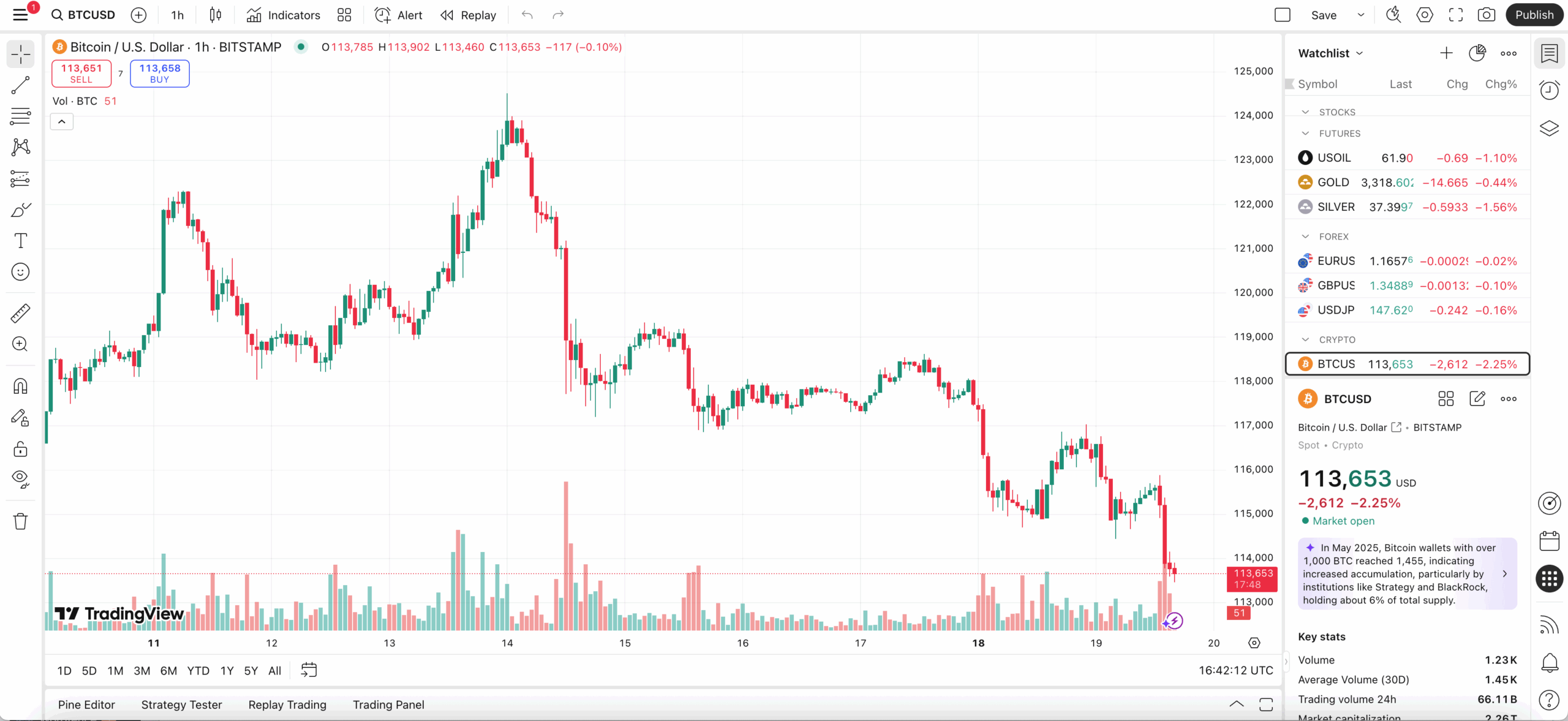

- Technical Analysis Signals – This is based on chart patterns, indicators (like RSI, MACD), and historical price action.

- News-Based Signals – Triggered by big announcements, partnerships, or regulatory news.

Paid vs. Free Crypto Signal Providers

You’ll come across both free and paid signal groups. Here’s the deal:

Paid Signals:

Usually offered as a subscription. The idea is that you’re paying for better accuracy, more details, and round-the-clock support. Some even include access to private communities where traders share insights.

Free Crypto Trading Signals:

Great for beginners, testing the waters. But keep in mind—they may not always be reliable or consistent.

What to Look for in a Reliable Signal Provider

Not all signal providers are trustworthy. Here are some red flags and green lights:

. Transparency – Do they show past results? Are their win/loss ratios clear?

. Reputation – Check reviews, forums, or Reddit discussions.

. Ease of Use – Are signals easy to understand, even for beginners?

. Risk Management – Do they include stop-loss and take-profit levels?

. Too Good to Be True – It is a scam if anyone promises 100% guaranteed profits.

Tips to Use Crypto Trading Signals Safely

Signals are useful tools, but they are not magic wands. Here are some tips for using them wisely:

Don’t Blindly Follow

Use them as a guide, not gospel truth. Always double-check signals.

Practice with Paper Trading

Test signals in demo accounts before risking real money.

Manage Your Risk

Never invest more than you’re willing to lose. Use stop-loss orders to protect your funds.

Stay Educated

Learn the basics of technical analysis. Even with signals, having your own understanding makes you a smarter trader.

Are Trading Signals for Crypto Worth It?

That depends on your goals.

If you’re brand-new and feel overwhelmed by charts, signals can save you time and stress. If you’re experienced, signals can confirm your analysis or give you trade ideas you hadn’t considered. But if you rely only on signals without learning anything yourself, you might struggle long-term.

The smartest traders often use signals as a supplement—not a replacement—for their own strategies.

Final Thoughts

Crypto markets don’t sleep, and neither do traders looking for an edge. Crypto signal trading can help you make smarter moves, avoid costly mistakes, and feel more confident in your trades.

But remember: no signal is perfect. Always pair signals with your own research, risk management, and common sense.

Used wisely, crypto trading signals can be the extra boost you need to level up your trading journey.