Introduction: The Solana Opportunity in the Crypto Market

As the crypto market evolves rapidly, many investors are wondering when the right time to buy Solana is and what signals they should be watching for. Solana has shown significant potential as a key player in the altcoin space, but how do you know when it’s the right time to make your move?

Let’s dive into the details and find out!

Understanding Solana’s Place in the Market

Before making any buying decisions, it’s important to address a common misconception. Many investors focus on Solana's price in US dollars, wondering, “Will it ever hit $1,000?” While it’s a question that comes up often, it’s not the best way to assess its potential. Instead, you should be comparing Solana’s price to major cryptocurrencies like Bitcoin and Ethereum. By doing this, you’ll get a much clearer view of its real growth potential and how it stacks up against the bigger players in the market.

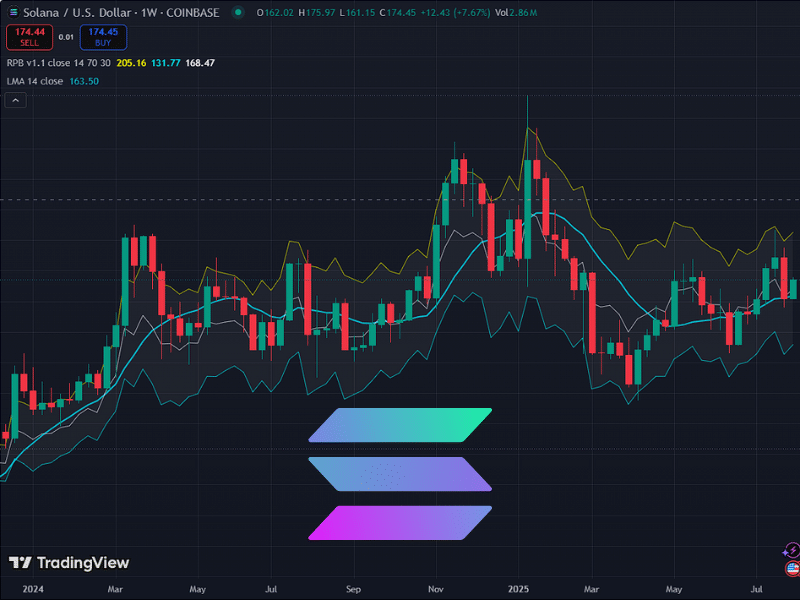

Tip: Logarithmic vs. Linear Charts

When analyzing Solana’s price movement, consider switching from linear charts to logarithmic charts. Linear charts can sometimes distort percentage changes, making it harder to see the true growth. On the other hand, logarithmic charts offer a much clearer picture of the actual growth, especially over time. This is crucial for investors looking to maximize their returns in a fast-moving market, as it helps you better understand how the price is truly evolving.

The Importance of Opportunity Cost in Crypto Investing

In the world of crypto, opportunity cost is a key factor when making investment decisions. If your money is currently tied up in Bitcoin, Ethereum, or Solana, it’s important to ask yourself if it’s the best use of your funds compared to other investment options. Holding USD long-term isn’t ideal because of inflation, and with the ever-shifting crypto market, comparing Solana to Bitcoin and Ethereum can help you make smarter, more informed choices. It’s about figuring out where your money will work hardest for you.

Solana vs. Bitcoin and Ethereum: Analyzing the Data

When we compare Solana to Bitcoin and Ethereum, we see a mix of underperformance and similar trends at different points. Ethereum is currently experiencing a surge in institutional demand, thanks to the growing interest in ETFs. This has led to a large portion of ETH’s supply being absorbed by institutional investors each year. Similarly, Bitcoin also feels the pressure of institutional buying, which has been a major driver of its market growth. Solana, on the other hand, hasn't quite seen the same level of institutional interest, but it’s still an important player to watch.

Solana’s Current Position

Solana has kept a steady position in the market, but it hasn’t garnered the same level of institutional interest as Bitcoin or Ethereum. While its market presence remains stable, it’s not seeing the same strong growth momentum that’s driving Bitcoin and Ethereum. Solana remains a solid cryptocurrency, but its growth has been slower compared to the rapid rise of its larger counterparts.

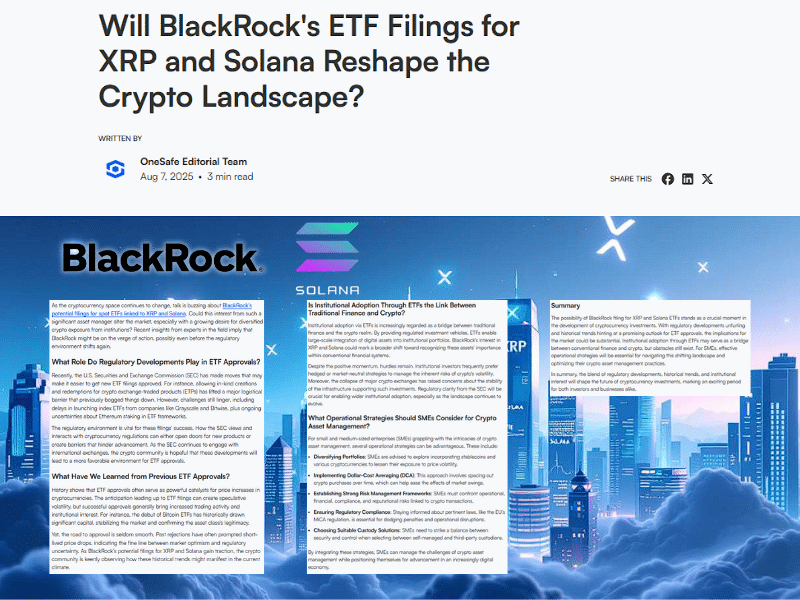

The US Solana ETF – A Game-Changer for Solana?

Alright, so here’s the deal: what could really make Solana take off? A US-based Solana ETF. If this thing gets approved—especially with BlackRock backing it—we could see institutional money flooding in. That could easily put Solana ahead of smaller altcoins.

Now, Canada already has a Solana ETF, but honestly, it hasn’t done much so far. The real change will come when we get a US-based ETF. We might see a bit of a price spike right after it gets approved, but the real growth usually happens weeks or months later, just like we saw with Ethereum’s ETF. It’s all about when the big institutional players step in with their cash

Current Investment Strategy: Balancing Bitcoin, Ethereum, and Solana

At The Crypto Code, we like to keep things balanced when it comes to our investment strategy. We hold a mix of Bitcoin, Ethereum, and Solana, adjusting our positions depending on how each one is valued compared to the others. While Solana may not be as undervalued as Bitcoin or Ethereum right now, it’s still a solid choice, especially when you compare it to smaller altcoins, which are more vulnerable to inflation and market instability.

The Key to Steady Returns

Right now, the US Solana ETF approval is something we’re really keeping an eye on. If that happens, it could really make a big difference. But when it comes to investing in weaker altcoins with high token inflation? That's a bit of a gamble. These kinds of coins often don’t perform well because of insider selling, making them good targets for shorting. That's why we prefer sticking with strong, reliable assets like Solana. It gives us a way to aim for steady returns, even when the market feels like it’s all over the place.

Conclusion: Why Solana Remains a Strong Choice

To wrap it up, Solana is still one of the stronger choices in crypto right now. We’re definitely keeping an eye on the US-based ETF approval; it could really be the game-changer. But even without it, Solana has solid growth potential, especially compared to smaller altcoins that tend to be more unpredictable.

The best way to approach this is to stay updated and adjust your positions based on what’s happening in the market. That way, you’re in a good spot to take advantage of the opportunity when it comes.

And as always, make sure you’re doing your own research and making informed decisions when it comes to your investments.