Picking good altcoins is important since many drop in value versus Bitcoin. This checklist can help you quickly see if an altcoin is worth your money.

This system points you to coins that might do well, helping you avoid the bad ones.

1. Start with a BTC Pair

When checking out altcoins, begin by comparing them to Bitcoin prior to checking their USD value. If an altcoin does not perform well against Bitcoin, think twice about holding it.

What to Look For:

- The value increases when compared with BTC.

- The price holds steady at a support level.

- A price point where you'll stop the trade if it drops below.

What to Avoid:

- Lower lows against BTC.

- A price that keeps falling.

- Quick gains that don’t last.

Altcoins that lose value when paired with BTC tend to keep losing value. It's often best to stay away from them.

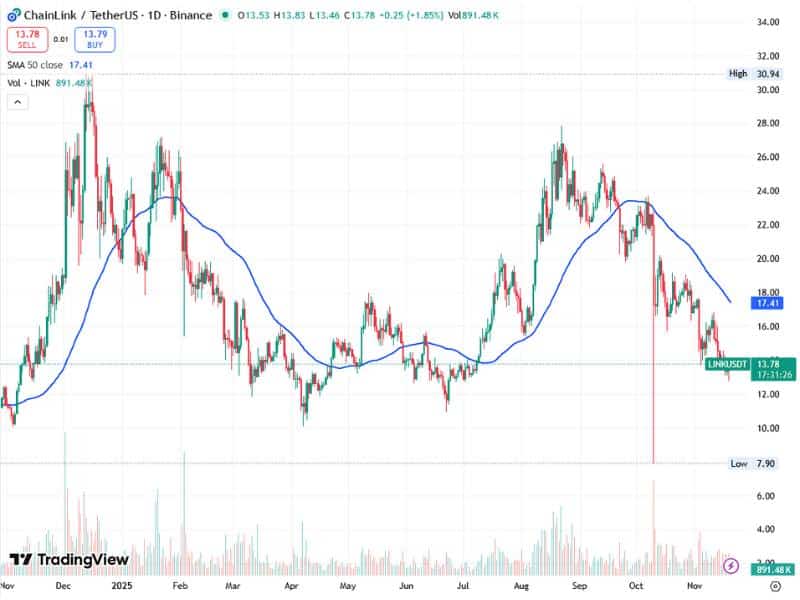

2. Check the USD Chart to See How Strong It Is

Once the BTC pair looks good, check the USD chart.

Signs of an Uptrend:

- Price bounces back above a key level.

- Good support stays where it is.

- Higher lows start to form.

- The general pattern looks positive.

Signs of a Downtrend:

- Price drops quickly.

- A key support level breaks.

- The price is consistently falling.

Even the best buy signals can fail if the timing is off. The USD chart can prevent losses before a major price shift.

3. Making Sense of Altcoins: Watch Where the Money Goes

In crypto, tracking the flow of money gives you clues about the direction a coin is going. Seeing where funds are moving can say a lot about what might happen with a project.

Ask yourself: Is money flowing into this project, or are investors leaving?

Keep an eye on big networks to see what's popular:

- Are people getting excited about Solana?

- Is Base becoming a go-to platform?

- What's up with Ethereum?

- Is BNB Chain seeing more usage, or less?

When money flows into a network, its corresponding tokens tend to increase in value. But when the money dries up, even good projects can struggle.

This simple idea can help you figure out which altcoins might do well and which ones might fail.

4. Watch What the Big Crypto Holders Do

Keep an eye on the big crypto wallets. Are they buying or selling a coin?

Buying Often Signals Positivity

If they're loading up, that's usually a good sign.

Selling Is a Warning

If the big players are selling, be cautious. It could mean:

- More coins will be up for grabs in the market, decreasing prices.

- There might be something wrong with the project.

- The hype might be dying down.

Following the moves of experienced investors can help you make better decisions.

5. Stay Aware of Trends and Public Opinion

In the crypto world, news often spreads before the price changes. Ideas can pick up speed quietly, so sharp people are already in the know by the time the price chart reacts.

Here's what to watch:

- A sudden increase in people talking about a project or idea

- A clear change towards positivity on social media

- More excitement among those in the community

- A rise in searches, posts, or general interest

In this market, what people are paying attention to matters. When an idea quickly becomes popular, it may mean something big is about to happen. Noticing it early can give you an edge.

6. Track Real-World Use and Blockchain Activity

A key way to see if a project will last is to check how people are really using it.

What to look for:

- Total Value Locked (TVL)

- DEX trading numbers

- Daily active users

- Monthly active users

- Project income

Good usage numbers don't guarantee prices will rise, but low use often signals trouble. If no one is using a project, its token might not do well.

7. Study Tokenomics Carefully

Many altcoins fail because of token supply mechanics, not fundamentals.

Critical Tokenomics Variables:

- Unlock schedules

- Emissions rate

- VC + team allocations

- Buybacks & token sinks

- Utility and value capture design

Heavy emissions with no counterbalance naturally suppress prices. A strong narrative can’t fix bad tokenomics.

8. Check Your Team, Story, and Belief

After you've looked at all the details, step back and check the bigger picture.

Ask yourself:

- Is the team always working to build and improve?

- Does the story still make sense now?

- Can you explain why you're investing in just a couple of sentences?

If you answer no to any of these, don't make the trade.

How Much to Invest

- More yes answers = invest more

- Fewer yes answers = invest less

- Too many problems = don't invest

9. Time to Check Up On Your Investments

With the market being calm now, here's what you can do:

- Sell off any underperforming investments.

- Reallocate funds to your better investments.

- Get ready for the next move in smaller altcoins.

This checklist is here to help you focus on the investments that work and get away from coins that are consistently losing money.