What's Up with the Crypto Market?

The crypto market is pretty wild right now. Prices jump around a lot, making things feel shaky, and people are worried. Some think things will get even worse, but the numbers tell a different story.

This could be a big bear trap, maybe the biggest we've seen in a long time.

Crypto often overreacts to fear more than other investments. Support levels fail, money disappears quickly, and it feels like the end of the world online. But these times—when fear is high and hope is low—can signal things are about to turn around.

The most important thing to watch is how money is moving around the world.

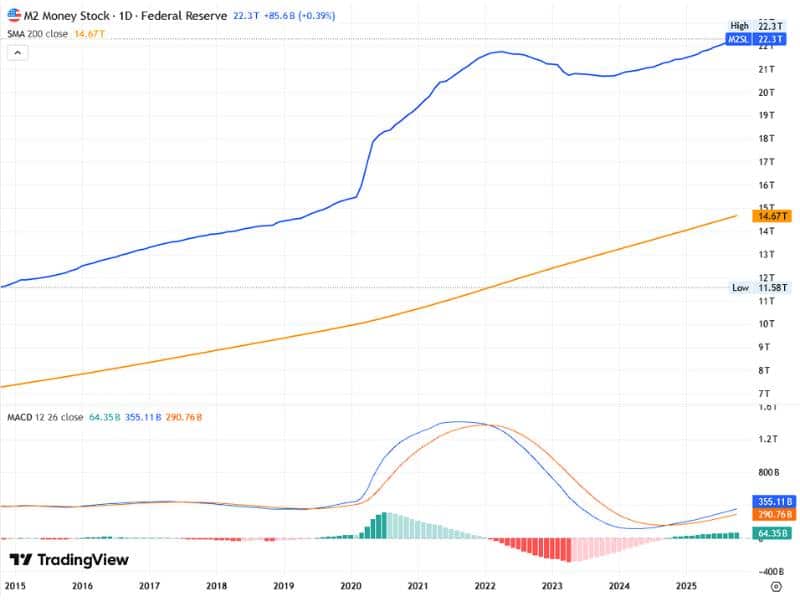

Global Money Flow Is Quietly Changing

Crypto reacts to money changes faster than the rest of the economy. Right now, how much money is available is starting to shift, little by little.

This matters because global money flow affects crypto trends in the long run. It's more important than interest rate cuts or how people feel about the economy. When the money flow changes, crypto usually moves first.

How Rate Cuts and QE Really Affect Crypto

People in crypto often talk about rate cuts and quantitative easing as if they’re the same, but they’re not. What's interesting is that only one of them has really helped crypto grow steadily.

Rate Cuts

When rates drop, it's easier to borrow. Loans for houses, companies, and credit cards cost less. That might help with money problems, but it doesn't create new money. No new money is added.

Are rate cuts useful? Yes.

Will they send crypto way up? Maybe not.

Quantitative Easing (QE)

QE is what matters. Central banks create new money and put it into the system by buying bonds. When that happens:

- Markets get a lot more cash.

- Bonds seem less appealing.

- People look for better investments.

- Crypto moves first, and it moves the hardest.

The biggest increases in crypto prices have happened when there's more money available, not just when interest rates go down.

The Fed: QE is Not Here, But Things Are Changing

The Federal Reserve isn't doing quantitative easing right now, but we may be seeing the end of very tight money.

Bank reserves are dropping, and the Fed is aware that very low reserves can cause issues in the money markets. The goal is to keep things stable.

What does this mean? It's not some secret QE scheme. It's a way to avoid cutting back money too fast and to keep the finances in good shape. This involves:

- Slowing down how quickly they reduce the balance sheet.

- Adjusting how reserves work.

- Keeping short-term money markets stable.

- Making sure bank reserves don't fall too low.

These aren't big changes, but they do point to a move away from very strict money control.

Crypto seems to react to this faster than stocks.

Crypto Reacts Fast

Because crypto markets are always open, they respond quicker than other markets to any changes in the money supply.

Even a small move toward easier money tends to show up in Bitcoin and other altcoins first. When money is easier to get, it often flows into riskier investments, like crypto.

The economy has issues:

- Job losses are increasing.

- Growth is slowing down.

- Companies are cutting back.

Central banks usually can't keep money tight when the economy is having a hard time. They often have to step in and loosen things.

Crypto picks up on this quickly.

Global Financial Conditions Are Easing

This isn't just in the U.S. Economies around the world are moving toward easier money:

- Japan is adding support.

- China is lifting restrictions to encourage growth.

- Europe is talking about lifting restrictions.

As the world's money supply grows and the U.S. economy eases up, crypto notices it right away. Since crypto is global, it’s often the first to spot new money coming into the system.

What's Happening with Crypto Now

We’re starting to see a real shift take place.

Money isn't flooding into the market yet, but it's not leaving as fast. The stage is being set for big crypto gains:

People are worried

The general feeling is negative

The market is moving a lot

Money issues are getting better

Global regulations are starting to be useful

This doesn't mean crypto will only rise. Expect:

Changes

Fake drops

Hard falls

Price drops due to fear

But even with all the chaos, things are getting better for the first time in a while. Small money shifts like we're seeing have started big Bitcoin and altcoin moves.

Things Are Calm Now, but Crypto Is Ready to Grow

The market looks messy and down. But under the surface, money is moving, the situation is improving, and the next big crypto phase is starting. Good investors don't react to news; they react to money flow.

Right now, that money flow is quiet. It's not obvious.

But crypto is watching.