Crypto Market: What's Next?

The crypto market is at a point where investors need to figure out their next move. The market's momentum has slowed, and there's growing worry and doubt about Bitcoin and other coins.

Every investor now faces a key question:

Are we bracing for more losses, or are we getting ready for the next chance?

Each cycle is different. Some pause and then keep growing. Others drop before they go way up. The main thing is not guessing right every time, but having a strategy for any market direction.

Bitcoin's Slowdown: What to Expect

Bitcoin's gains have slowed down recently, and the mood in crypto has shifted quickly as a result. When things slow down, many people tend to expect a bigger drop. But that is not always the case.

Looking back:

- Some cycles consolidate before increasing again.

- Others fall back before starting over.

- This transition time always involves doubt.

That is why investors should consider how they want to position themselves before the next big move.

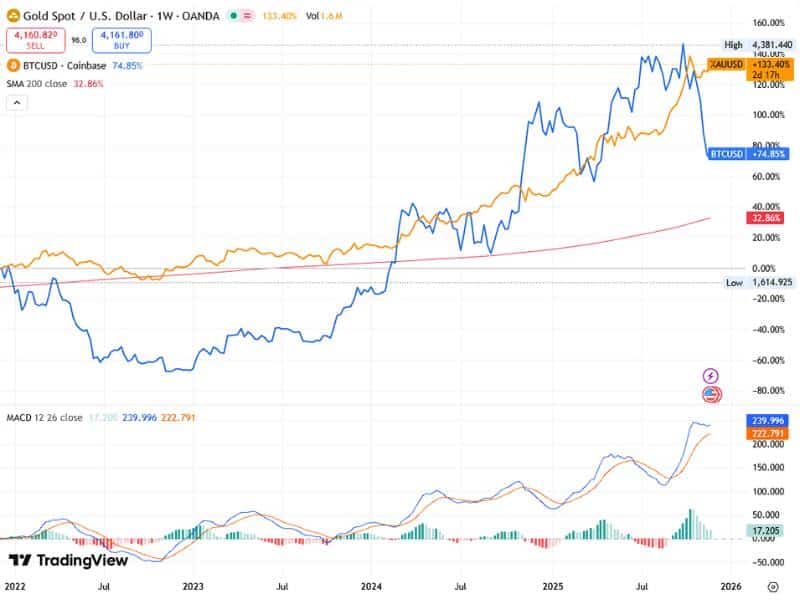

Strategy #1: Go for Gold to Stay Steady

When things get shaky, some investors move a portion of their funds into gold as a safe play.

Why gold?

- It keeps its worth when the market drops.

- It doesn't jump around like those altcoins.

- Its value has grown slowly but surely over the years.

- It keeps your money safe without you having to leave the market completely.

If you want to play it safe while waiting for the crypto market to pick back up, gold can help you sleep better at night.

Strategy #2: Use Stablecoins to Protect Your Money

Stablecoins are still the easiest way to avoid losing money while keeping your options open.

Why stablecoins?

- It’s easy to get back into crypto when things look better.

- Perfect for a wait-and-see approach.

- You don't have to worry about Bitcoin or altcoins going crazy.

Just be careful with risky interest-earning programs when the market is unstable. Right now, it’s more important to protect what you have than to earn extra.

Strategy #3: Moving into Bitcoin to Reduce Risk

Instead of keeping your money in riskier altcoins, some people move it into Bitcoin as a safer choice.

Here’s why Bitcoin is often seen as the safer crypto:

- It usually doesn't fall as much during big market drops.

- It's usually one of the first to rise when the market starts to recover.

- It lowers your risk from very high price swings.

- You still have the chance to make gains if the market goes up.

When the market starts to improve, Bitcoin often gives early signs, which lets you move back into altcoins at better prices.

Strategy #4: Using Tax-Loss Harvesting to Rebuild Your Investments

This strategy takes more work, but it can be very helpful over time.

Here’s how tax-loss harvesting works:

- Sell investments that have lost value.

- Claim the loss on your taxes.

- Buy back only the coins you really believe in.

- Lower the price you paid for your coins on average.

This helps you make a profit faster when the market recovers. You can also rebuild your investments with projects that you're confident in for the future.

What's the Best Way to Invest?

The truth is, there's no single strategy that suits everyone. Each choice has its pros and cons, and the right one hinges on the investor using it.

Going all-in on altcoins means big potential profits, but also huge losses if things go south. It's a high-risk, high-reward game.

Switching to Bitcoin offers a balance. You still get good upside, but with way more stability than smaller altcoins. The downside is that it won't jump as high as those riskier coins.

Gold, though, is about keeping safe. It's steady and helps protect your money when things get shaky. But it won't catch those major crypto booms during good times.

Going into stablecoins is the safest move. There's no unpredictable price fluctuation, which helps protect your investments when the market drops. But you need to know when to jump back in, or you might miss the next big rally.

Then there's tax-loss harvesting, which can save you a lot of money over time and help you clean up your portfolio. But it takes some work and knowledge of your local tax laws.

In the end, the best way to invest is what matches your goals, how comfortable you are with ups and downs, and how involved you want to be with your investments. Most people mix these methods to protect what they have, stay ready for the next chance, and set themselves up for long-term growth.

Final Thoughts: Be Ready for Anything

The market always has surprises, and nobody knows exactly what will happen. So, it’s important to have a plan that:

- Matches how much risk you can handle

- Protects your money when things get tough

- Keeps you set for the next big chance

Whether the market drops or keeps going up, the people who plan, instead of panicking, will be in great shape.